Quigley’s Corner 06.04.18: Investment Grade DCM New Issue Market: Goldman Sachs Bank USA Debt IPO

Investment Grade New Issue Re-Cap – IG Dollar DCM on Fiyaaahhhhhh!!

Today’s IG Primary & Secondary Market Talking Points

Syndicate IG Corporate-only Volume Estimates For This Week and June

Goldman Sachs Bank USA Inaugural $1bn Debt IPO – 2yr 3(a)2 Exempt Senior Unsecured Notes due 6/05/2020

Goldman Sachs Bank USA Deal Dashboard

Goldman Sachs Bank USA – Commitment to Diversity & Inclusion

The “QC” Geopolitical Risk Monitor

NICs, Bid-to-Covers, Tenors, Sizes and Average Spread Compression from IPTs thru Launches

New Issues Priced

Indexes and New Issue Volume

Global Market Recap

2018 Lipper Report/Fund Flows – Week ending May 30th

IG Credit Spreads by Rating

IG Credit Spreads by Industry

New Issue Pipeline

M&A Pipeline

Economic Data Releases

Rates Trading Lab Tomorrow’s Calendar

So, how brilliant is Moody’s Corp. and our friend Zeeshan Naqvi for timing last Friday’s Moody’s Corp. issuance? Looks like it’s opened up a whole new world for our IG dollar DCM as 10 issuers priced 16 tranches today totalling $9.95b. The SSA space was quiet again. What’s more The Goldman Sachs Group, Inc. will now be issuing any tenors 3-years and in thru their new entity – Goldman Sachs Bank USA that issued its debt IPO in today’s session. As a result, it is the session’s Deal-of-the-Day as Mischler, the nation’s oldest Service Disabled Veteran broker-dealer is proud to have been selected as an active Co-Manager on the inaugural issuance.

We greatly appreciate that Team GS Treasury/Funding and Syndicate! I’ll also be featuring a nice segment about the wonderful initiatives that Goldman Sachs has been focused on for our nation’s veterans. It highlights GS’s Integration Program, involvement with VOWS, Networking and Mentorship, the Goldman Sachs Gives program and a bit about Goldman’s Community Teamworks.

But before the relative value exercise, book build review and Veteran Diversity Initiative at the House of Gold, let’s first review the day:

Here’s a look at the WTD and MTD IG Corporate new issue volume as measured against syndicate desk estimates:

- The IG Corporate WTD total is 39.42% of this week’s syndicate midpoint average forecast or $9.95b vs. $25.24b.

- MTD we’ve priced 11.67% of the syndicate forecast for April IG Corporate new issuance or $10.555b vs. $90.44b.

- There are now 18 issuers in the IG credit pipeline.

Today’s IG Primary & Secondary Market Talking Points

- PSEG Power LLC increased today’s 5-year Senior Notes new issue to $700mm from $600mm at the launch and at the tightest side of guidance.

- Puget Sound Energy Inc. upsized today’s 30-year FMBs to $600mm from $500mm at the launch and at the tightest side of guidance.

- The average spread compression from IPTs and/or guidance thru the launch/final pricing of today’s 16 IG Corporate-only new issues was <13.375> bps.

- BAML’s IG Master Index tightened 1 bp to +121 vs. +122. (It’s post-Crisis low is +90 set on 2/01).

- Bloomberg/Barclays US IG Corporate Bond Index OAS was unchanged at +1.15. (1.15 represents a new high. 0.85 is its post-Crisis low set on 1/30).

- Standard & Poor’s Investment Grade Composite Spread tightened 2 bps to +153 vs. +155. (+125 represents its post-Crisis low set 2/02).

- Investment grade corporate bond trading posted a final Trace count of $16b on Friday versus $22.5b on Thursday and $6.9b the previous Friday.

- The 10-DMA stands at $16.8b.

Syndicate IG Corporate-only Volume Estimates For This Week and June

| IG Corporate New Issuance | This Week 6/04-6/08 |

vs. Current WTD – $9.95mm |

June 2018 | vs. Current MTD – $10.555b |

| Low-End Avg. | $24.44b | 40.71% | $91.24b | 11.57% |

| Midpoint Avg. | $25.24b | 39.42% | $90.44b | 11.67% |

| High-End Avg. | $26.04b | 38.21% | $89.64b | 11.77% |

| The High | $20b | 49.75% | $75b | 14.07% |

| The Low | $35b | 28.43% | $110b | 9.60% |

Goldman Sachs Bank USA Inaugural $1bn Debt IPO – 2yr 3(a)2 Exempt Senior Unsecured Notes due 6/05/2020

Mischler Financial is very happy to announce that it was invited to serve as an active 0.50% active Co-Manager on today’s $1b 3-year 3(a)2 Exempt Senior Unsecured Notes new issue for Goldman Sachs Bank USA. This represents the issuer’s inaugural debt transaction (IPO) and as a result, it’s also Mischler’s first Co-Manager role for this new GS Bank USA entity.

In terms of the relative value approach to today’s issuance I looked at another stalwart U.S. six-pack with its own healthy and historic brand of D&I procurement initiatives making for a nice comparable on myriad levels namely Citigroup NA’s $2bn 3.05% Senior Unsecured Bank Notes due 5/01/2020 and also rated A1/A+ that priced this past March 23rd. They were G+63 bid with no differential between Goldman and Citi 3-year paper and with the 5-year Holdcos about a nickel or 5 bps between them. That would peg a new GS 2-year at anywhere from G+63-68 so, let’s split the difference to get us to G+65.5 landing NIC on today’s new Goldman Sachs Bank USA issue that priced at T+70 as 4.5 bps.

Goldman Sachs Bank USA Deal Dashboard

Use of proceeds from today’s transaction will be used for general corporate purposes.

| GS Issue | RATING | IPTs | GUIDANCE | LAUNCH | PRICED | Spread Compression |

NIC (bps) |

Trading at the Break |

+/- (bps) |

| 2yr FXD 3(a)2 | A1/A+ | +80-85/+82.5a | +70 the # | +70 | +70 | <12.50> bps | 4.5 | 66/64 | <4> |

………and here’s a snapshot of today’s final Goldman Sachs Bank USA book size and oversubscription rate – the measure of investor demand:

Today’s Goldman Sachs Bank USA final order book finished at $4.20b making the $1b debt IPO 2-year 3(a)2 Exempt Senior Unsecured Notes transaction 4.20x-times oversubscribed. “At the top” or at guidance, the book also happened to top out at the same $4.20b level. That’s right folks, please note it is an exceedingly rare occasion for our IG dollar DCM to feature a new issue that had “NO DROPS” between the book at the top and the final book size. A clear indicator of a highly successful transaction. Congrats to the Goldman Sachs Bank USA A-Team formerly known as the Goldman Sachs A-Team!!!

| MCO Issue | Tranche Size | Book at-the-Top |

Final Book Size |

Bid-to-Cover Rate |

| 2yr FXD 3(a)2 | 1bn | 4.20b | 4.20b | 4.20x |

Final Pricing – Goldman Sachs Bank USA

GS $1b 3.20% due 6/05/2020 @$99.977 to yield 3.212% or T+70 MWC +15

Goldman Sachs Bank USA – Commitment to Diversity & Inclusion

You all read here time and time again the wonderful D&I initiatives created by and applied by the largest corporations who issue bonds in our financial services industry. If Mischler is involved, I’m getting YOUR story out there. Today it is Goldman Sachs’ turn and what a story it has historically been with Team GS and their commitment not only to social responsibility but to Veteran causes. It is always my privilege and honor to help get Goldman’s story to YOU and to Main Street. It’s only one week detached from Memorial Day and given that the other two diversity Co-Managers were Veteran-owned and operated firms (Academy and Drexel) I would say this is a nice representative Memorial Day transaction of sorts for the Golden Ones at Team GS in honor of our nation’s heroes.

I ask you to please take a moment to read about just some of the wonderful ways that Goldman Sachs helps our nation’s men and women in uniform and our service-disabled veterans, all who were and are prepared to make the ultimate sacrifice so we can do what we do here in the Land of the Free thanks to the Home of the Brave.

Thank you Team GS. (Jonny, Jane, Jess, Gaurav, Jason, Liz, Tony, Katie et al). You make a difference in our veterans’ lives and you help our great nation’s oldest Service Disabled Veteran broker-dealer grow in a more meaningful and sustainable way. Thank yous also go out to our loyal accounts who likewise aren’t just helping us all execute good business in a value-added way but who are also helping us give back a share of those profits to veteran causes. You all know who you are and we appreciate each of you.

Veterans Integration Program

The two-month Goldman Sachs Veterans Integration Program (VIP) provides service men and women exiting the military with an opportunity to develop their professional skills, strengthen their understanding of financial services and prepare for careers in the industry.

Veterans know what it takes to be a part of a team. Goldman Sachs is proud to have them on theirs.

Skills that are second nature to military veterans like leadership, teamwork and problem solving are in high demand in our industry – and Goldman Sachs considers these traits invaluable.

Launched in 2012, the Goldman Sachs Veterans Integration Program (VIP) provides service men and women exiting the military with an opportunity to develop their professional skills, strengthen their understanding of financial services and prepare for careers in the industry.

The program enables Goldman Sachs to recruit talented troops who are transitioning from the military to the civilian workforce. Goldman Sachs encourages those who have completed at least one year of active military service and demonstrate an interest in financial markets to apply.

Outside of their day-to-day responsibilities, participants complete a curriculum including a series of trainings on financial markets and products, networking opportunities and events with Goldman Sachs leaders who share career experiences and insights into the firm’s culture. While in the program, each VIP participant is paired with a peer buddy and a mentor from the Goldman Sachs Veterans Network.

Veterans On Wall Street (VOWS)

Goldman Sachs co-founded Veterans on Wall Street (VOWS), an initiative that helps former and current military personnel discover career opportunities in finance. On November 10, 2015, Goldman Sachs hosted the fifth annual VOWS Symposium and Hiring Fair.

Networking and Mentorship

The Goldman Sachs Veterans Network recruits talented troops and fosters their professional development at the firm. The network also advises on military-related engagements – with nonprofits, veteran-owned businesses and the community – to ensure that Goldman Sachs is a military employer-of-choice and a corporate leader in veterans’ affairs.

Goldman Sachs Gives

Goldman Sachs Gives (GSG) funded a network of nonprofits whose mission is to reintegrate wounded and disabled veterans. The initiative focuses on job placement and readiness, and family support and counseling. Partners include: The Mission Continues, offering service-based fellowships to veterans; Vets Prevail, providing mental health counseling and resources; and Team Rubicon, deploying returning veterans to assist in disaster relief.

Goldman Sachs Gives is committed to fostering innovative ideas, solving economic and social issues, and enabling progress in underserved communities globally. Through a donor-advised fund, Goldman Sachs’ current and retired senior employees work together to recommend grants to qualifying nonprofit organizations to help them achieve their goals.

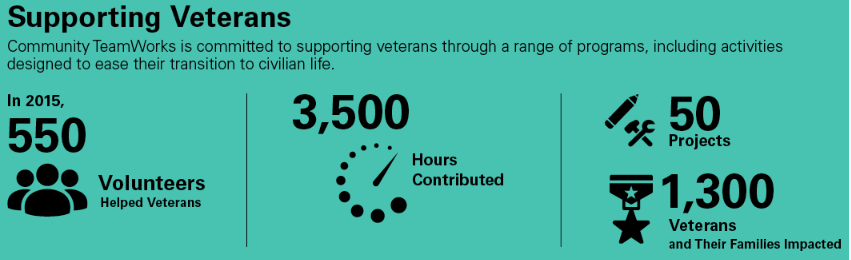

Community Teamworks

As part of Community TeamWorks, the people of Goldman Sachs support veterans through team-based volunteer projects around the world. In 2015, 550 volunteers contributed 3,500 hours to help 1,300 veterans and their families.

So, when I write here in the “QC” that D&I is in a corporation’s DNA, the aforementioned is a perfect illustration of exactly what that means.

The “QC” Geopolitical Risk Monitor

Above is the opening extract from Quigley’s Corner aka “QC” Monday, June 4, 2018 edition distributed via email to institutional investment managers and Fortune Treasury clients of Mischler Financial Group, the investment industry’s oldest minority broker-dealer owned and operated by Service-Disabled Veterans.

Cited by Wall Street Letter in each of 2014, 2015 and 2016 for “Best Research / Broker-Dealer”, the QC is one of three distinctive market comment pieces produced by Mischler Financial Group. The QC is a daily synopsis of everything Syndicate and Secondary as seen from the perch of our fixed income trading and debt capital markets desk and includes a comprehensive “deep dive” with optics on the day’s investment grade corporate debt new issuance and secondary market data encompassing among other items, comparables, investment grade credit spreads, new issue activity, secondary market most active issues, and upcoming pipeline.

To receive Quigley’s Corner, please email: rkarr@mischlerfinancial.com or via phone 203.276.6646

*Sources: Bank of America/Merrill Lynch, Bloomberg, Bond Radar, Dow Jones Newswire, IFR, Informa Global Markets, Internal Mischler, LCDNews, Market News International, Prospect News, Standard & Poor’s Ratings Services, S, Thomson Reuters and of course, a career of sources, contacts, movers and shakers from syndicate desks to accounts; from issuers to originators; from academicians to heads of research, and a host of financial journalists, et al.

Mischler Financial Group’s “U.S. Syndicate Closing Commentary” is produced daily by Mischler Financial Group. No part of this document may be reproduced in any manner without the permission of Mischler Financial Group. Although the statements of fact have been obtained from and are based upon sources Mischler Financial Group believes reliable, we do not guarantee their accuracy, and any such information may be incomplete. All opinions and estimates included in this report are subject to change without notice. This report is for informational purposes and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Veteran-owned broker-dealer Mischler Financial Group, its affiliates and their respective officers, directors, partners and employees, including persons involved in the preparation of this report, may from time to time maintain a long or short position in, or purchase or sell a position in, hold or act as market-makers or advisors or brokers in relation to the securities (or related securities, financial products, options, warrants, rights, or derivatives), of companies mentioned in this report or be represented on the board of such companies. Neither Mischler Financial Group nor any officer or employee of Mischler Financial Group or any affiliate thereof accepts any liability whatsoever for any direct, indirect or consequential damages or losses arising from any use of this report or its contents.