Investment Grade New Issues: PepsicCo Inc. Prices D&I Debt Issue; SDV Owned & Operated Mischler Financial Group is a Joint Lead, along with (7) other diversity-certified investment banks.

Below is excerpted from the October 05, 2020 edition of Quigley’s Corner, Mischler Financial Group’s daily debt market coverage and commentary distributed to Fortune 500 treasury teams, leading institutional investors, and the sell-side’s most recognized fixed income syndicate desks.

Today the IG Corporate dollar DCM hosted 6 issuers across 9 tranches totaling $7.45b. The SSA space added Swedish Export Credit’s $1.25b 3-year Global Notes transaction due 9/29/2023 bringing the all-in IG day totals to 7 issuers, 10 tranches and $8.70b.

Today’s historic Deal-of-the-Day is all about Pepsi’s $750mm 3-year tranche of it’s two-part $1.5b issuance as it featured 8 Diversity-certified broker-dealers. It is a great story with LOTS for my readership to chew on and think about. Let’s review the session data points first and then it’s on to what I hope is an illuminating “QC” for all of you!

Today’s historic Deal-of-the-Day is all about Pepsi’s (NYSE:PEP) $750mm 3-year tranche of it’s two-part $1.5b issuance, as it featured 8 Diversity broker-dealers. It is a great story with LOTS for my readership to chew on and think about. Let’s review the session data points first and then it’s on to what I hope is an illuminating “QC” for all of you!

PepsiCo, Inc. is American multinational food, snack, and beverage corporation headquartered in Harrison, New York, in the hamlet of Purchase. It is the largest food and beverage business in North America by net revenue and the world’s second-largest. One of the critical bars for the food and beverage industry’s main brands is annual sales of over $1 billion. PepsiCo, Inc. has 23 brands that meet that lofty requirement including but not limited to Pepsi, Diet Pepsi, Mountain Dew, Lay’s, Gatorade, Tropicana, 7 Up, Doritos, Quaker Foods, Cheetos, Ruffles, Tostitos, and Fritos among others. A pretty impressive and diverse list and statistic right there! PepsiCo products are enjoyed by consumers more than one billion times a day in over 200 countries and territories around the world generating more than $67 billion in net revenue. Equally impressive is the global nature of the Company’s success with product development, marketing, and processing. From North America throughout Latin America; from Europe and Sub-Saharan Africa to Asia and North Africa, the PepsiCo name is one of the world’s most recognizable brands. There is a reason why they want and need to appeal to a vast and immensely diverse global customer base.

Back in 2006 PepsiCo’s former CFO and President Indra Nooyi replaced Steve Reinemund as the Company’s Chief Executive Officer and later added Chairman of the Board to her hats in 2007. Nooyi was named #1 on Fortune’s list of the “50 Most Powerful Women” and #6 in Forbes’ list of the “World’s 100 Most Powerful Women.” How fitting then that under the new Chairman and CEO, Ramon Laguarta, since October 2018, PepsiCo continues to break new ground by turning the dial up on Diversity and Inclusion once again in a landmark way. PepsiCo’s very capable Treasury/Funding team leaders announced the Company’s first Diversity & Inclusion transaction today that included 8 active joint lead D&I broker-dealers. The offering was once again stabilized by the brainchild of such new issues – the ever-present and supportive Team Citigroup Syndicate and Origination. Today’s 3-year transaction included a total of 8 D&I broker-dealers canvassing certifications from African-American to Hispanic-American; from Service Disabled Veteran and Veteran firms to Women-owned boutique investment banks and J.P. Morgan PepsiCo’s wonderful tradition of and commitment to D&I and the “S” that underscores “Social” in ESG raised the bar once again, this time in the financial services industry, with today’s inaugural offering. Congratulations to all involved. It’s a privilege and an honor for team Mischler to have been selected as one of the elite diverse broker-dealers in our industry to represent our SDVBE certification. We appreciate your recognition and reward of our value-added distribution and debt capital markets’ daily coverage proposition.

Today’s inclusion will help our firm to continue to grow in a more meaningful and sustainable way so that we’re around for many, many years to come. From the offices of Chairman and CEO Ramon Laguarta to EVP and Chief Sustainability officer Jim Andrew over to Hugh F. Johnston Vice Chairman and CFO to the Treasurer, SVP and Assistant Treasurer and the entire treasury/Funding team, PepsiCo’s chain of command, from the top down, illustrated its commitment to D&I today. There is not one weak link along that chain. That’s how to execute an internal mandate perfectly.

PepsiCo, Inc. 3-year Deal Dashboard

………here’s a snap shot of today’s final PepsiCo Inc’s. order book size and oversubscription rate throughout the book build – the measure of investor demand:

| PEP New Issue |

Tranche Size | Book At-the-Top |

Final Book | Bid-to-Cover Rate |

| 3 year | $750mm | $4.5b | $3.2b | 4.27x |

……and here’s a check of spread compression from IPTs thru the launch and final pricing, NIC and where the paper is currently trading. The direct comparable for today’s relative value study looked to the outstanding PEP 0.75% Senior Unsecured Notes due 5/01/2023 that were +25 bid pre-announcement this morning pegging NIC on today’s new 10-year that priced at +23 as negative <2> bps. So an inside secondary final pricing level for PepsiCo’s first ever D&I issuance. You can’t beat that any way you look at it.

| PEP New Issue |

Ratings | IPTs | GUIDANCE | LAUNCH | PRICED | SPREAD COMPRESSION |

NIC (bps) |

TRADING at the BREAK |

+/- (bps) |

| 3 year | A1/A+ | +45a | +25a (+/-2) | +23 | +23 | <22> bps | <2> | +21.5 | <0.5> |

PepsiCo, Inc. $1.5b 3-year Senior Notes Final Pricing Details:

$750mm 0.40% Senior Notes due 10/07/2023 @$99.943 to yield 0.419% or T+23 MWC +5

PepsiCo Inc’s. History of D&I and the “S” for “Social” in ESG (Environmental, Social & Governance)

PepsiCo, Inc. continued its long tradition of advancing social sustainability with today’s inaugural D&I transaction. But it’s worth a look back at some of the great inflection points along the Company’s historic road to advancing D&I. It’s clearly something ingrained in the Company’s corporate DNA. One looks to the past for inspiration for continued advances in the future. As the world changes so do companies. As the world changes socially, it is a company’s social responsibility to change with it. Look no further than 1947 when Pepsi’s Harvey C. Russell was a member of the first all-black sales force specifically created to market the Pepsi product to the African-American community. Russell then became the Company’s first black officer and the first of a major multinational corporation in 1962. As a reference, yours truly was one-year-old which speaks to how long PepsiCo has been on board with D&I. 17 years ago, in 2003, PepsiCo created the Harvey C. Russell Inclusion Award to recognize Company associates who go above and beyond to support its diversity efforts. For what it may be worth to PepsiCo I’d like to nominate the entire PepsiCo Treasury/Funding team for this year’s award for today’s significant inaugural D&I transaction that communicates a powerful message to the financial services industry and the world. As the cliché goes, “put your money where your mouth is” and PepsiCo did just that today with its inclusion of EIGHT Tier I diversity firms on this landmark transaction.

In so far as service-disabled veterans and veterans are concerned I am honored to mention PepsiCo’s Valor resource group that annually honors our men and women veterans. Each year on Memorial Day PepsiCo’s truck drivers pay tribute to the Company’s war veterans with “Rolling Remembrance” – a 5,400-mile journey from California to New York to transport an American flag once flown on a U.S. military combat mission. Additionally, for the past 38 years, PepsiCo has committed to supporting the development and growth of minority suppliers by sourcing goods and services from a diverse supplier base. That’s good stuff right there readers. Think about it. D&I and ESG is here to stay.

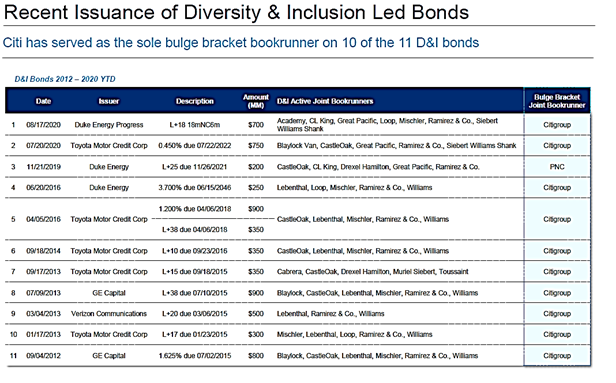

One simply cannot talk about D&I led bond issues without dedicating a prominent section for Citigroup. Despite the participation of another stalwart bulge bracket investment banks on today’s 3-year D&I tranche (J.P. Morgan), it is indeed Citigroup who structured transactions like today eight years ago. They are a six-pack bulge bracket bank that ranks #3 in the all-important IG Corporate Bond Underwriting League table. They have one of, if not the oldest internal D&I procurement initiatives in our IG dollar DCM.

On CITI self-led transactions, they reward a value-added distribution proposition as well as appreciate daily DCM updates every day of the year. They take the time because they make the time to get to know D&I broker-dealers whether the legacy firms or the new ones. Witness their 16th Annual D&I breakfast that was held, as it always is, in April of this year. Naturally, nothing could cancel this annual event and so it went on despite the pandemic via WebEx. They do it right at Team Citi. In fact, although I don’t think one can copyright a deal structure, I can tell you that if one could, the copyright for D&I transactions such as today’s PepsiCo 3-year was brainstormed, conceived, and executed by Citigroup, Inc. If I had to name the names of the people at Team Citi who have dedicated years working on this mandate the list would be much too long. I can say that Peter and Patrice in Origination and the entirety of Team Citi Syndicate – David, Jim, Tim, Scott, Aoiffe, all the associates and analysts (apologies if I have forgotten anyone) all played a critical role in the creation and success of this most meaningful of D&I mandates in our investment grade debt capital markets. But a separate shout-out goes to Kevin O’Sullivan aka “KO” who was masterful in leading calls that began last week and maintaining relationships with all the D&I b/ds involved. He knows his stuff inside out, is quick and efficient with any/all syndicate mechanical questions, and knows how to take charge and lead by example. His knowledge in the art and craft of syndicate is only matched by his personality, good humor, and great attitude.

So, although this is a departure for me in that I typically focus on the issuer and the issue at hand it’s about time for issuers to take pause and reflect upon how substantial Citigroup’s influence has been and continues to be with D&I and its cast of players in our financial services industry. There is a reason why Citigroup has led 91% of all these types of transactions. I think it’s safe to say they own it!

You want a track record? ……..just take a look at this:

Please let’s give a round of applause for the freedom within Citigroup that encourages its originators, bankers and syndicate teams to think outside of the box to create such a transaction and then to flawlessly execute upon it time and time again. Citigroup has the backs of all the legacy and new minority broker-dealers while encouraging all of us throughout the years to stick to the mandate, to never give up on it, and to understand the huge potential it offers for social responsibility. Thanks also to the good people who work WITH us at Team Citi; for helping us to get better at what we do every day in this business; for their encouragement; for their availability; for the opportunities they’ve created for all of us and “yes” for being all-around good-natured, easy to work with and fun people. All of those ingredients combine to make one magnificent recipe that started as a rare and unique opportunity but one that is firmly planted in our IG dollar DCM and financial services industry. The D&I and ESG mandates will only continue to flourish ……..it’s here to stay. Collectively you are the best!

D&I and ESG Issuances: Here to Stay

Make no mistake about it, the audience for ESG-centric financial products is growing and expanding. Whether it’s green bonds, social responsibility issuances, social/sustainability bonds, or even “labelled” offerings, the pace of issuance for these types of investment products is accelerating.

I can tell you all that the view from 50,000 feet in the C-suite of corporations, sovereign wealth funds and countries all over the world are telling the largest loan lending institutions (typically away from e-mails and recorded lines and text messages) the following: “Get on board with ESG or whatever you like to call this type of issuance because if you don’t there are hundreds of other reputable banks that would love a fraction of your loan lending business.”

My readership knows me very well. I don’t put things like that out there for general consumption unless I KNOW that’s what’s being said behind closed doors. Take what you want and leave the rest, but rest assured ESG and D&I is a better practice, and here to stay for the very long haul in our ever-changing world.

I firmly support the mandate as long as it is a value-added proposition. If I ever hear that companies are writing fat checks just to “check-the-box”, that’s when I’d pack my bags and say, “vaya con dios folks!”

As we all learned in the 90’s, the diversity mandate was often about one thing – the person whose name is on the door of the firm. That’s when it becomes nothing more than a get rich quick scheme for one person. That concept died a sudden death about 10-12 years ago. I, like some select others, personally stayed with it because I/we believed that one day, someday, a firm will get this mandate right. Today’s offering illustrates 8 sustainable firms out there who did just that. These issuances appeal to a much wider investor audience, they can be eligible for broader indices, they tend to have larger order books and price at tighter spreads.

Just look at today’s Pepsi 3yr with a 4.27-times bid-to-cover rate that priced with a negative <2> bp concession which in turn, lowers borrowing costs. IG Corporate issuance dominates our IG dollar DCM today but sovereigns in particular in Europe are becoming more focused on climate change and social issues have burst wide open in our financial services industry. You don’t need to credit me for being vocal about it, just look around. It’s all out there. It’s real, it’s tangible and it makes for very good business.

PepsiCo, Inc. specifically said they added 8 diversity owned broker-dealers today as joint leads to capture new incremental tier II and III middle markets accounts to their profile. They got that delivered to them today. Value-added folks…..all about the value-added proposition! And we thank them for that.

Last but not least a profound thank you to the loyal distribution network that helps Mischler differentiate from the pack. Your participation through us, whether in joint lead or active Co-Manager roles is a HUGE value-add. We appreciate your patronage on every single transaction.

New Issues Priced

| Issuer | Ratings | Coupon | Maturity | Size | IPTs | GUIDANCE | LAUNCH | PRICED | LEADS |

| Berkshire Hathaway Inc. | Aa2/AA | 1.45% | 10/15/2030 | 750 | +95a | +75a (+/-3) | +70 | +70 | BofA/JPM |

| Berkshire Hathaway Inc. | Aa2/AA | 2.85% | 10/15/2050 | 1,750 | +155a | +130a (+/-3) | +127 | +127 | BofA/JPM |

| Everest Reinsurance Holdings | Baa1/A- | 3.50% | 10/15/2050 | 1,000 | +220a | N/A | +200 | +200 | CITI/WFS (a) HSBC (p) |

| Leidos Holdings Inc. | Baa3/BBB- | 2.30% | 2/15/2031 | 1,000 | +187.5a | N/A | +160 | +160 | BofA/CITI/MUFG |

| PepsiCo, Inc. **Inaugural Diversity & Inclusion Issue** |

A1/A+ | 0.40% | 10/07/2023 | 750 | +45a | +25a (+/-2) | +23 | +23 | CITI/ACAD/COAK/DREX/JPM LOOP/MISCHLER/SEEL/RAM SIEB |

| PepsiCo, Inc. | A1/A+ | 1.40% | 2/25/2031 | 750 | +87.5a | +70a (+/-3) | +67 | +67 | CITI/JPM/MS |

| Protective Life Global Fdg. FA-backed |

A1/AA- | 0.631% | 10/13/2023 | 500 | +65a | +45 # | +45 | +45 | BofA/MIZ/PNC/WFS |

| WEC Energy Group Inc. | Baa1/BBB+ | 1.375% | 10/15/2027 | 500 | +115a | +90a (+/-5) | +85 | +85 | BARC/JPM/KEY/TD/UBS/WFS |

| WEC Energy Group Inc. | Baa1/BBB+ | 1.80% | 10/15/2030 | 450 | +130a | +110a (+/-5) | +105 | +105 | BARC/JPM/KEY/TD/UBS/WFS |

Above is the opening extract from Quigley’s Corner aka “QC” 10-05-20 edition distributed via email to institutional investment managers, lead underwriter syndicate desks, and Fortune Treasury clients of Mischler Financial Group, the investment industry’s oldest diversity-certified broker-dealer owned and operated by Service-Disabled Veterans.

The QC is a daily synopsis of everything Syndicate and Secondary as seen from the perch of Mischler’s primary debt capital markets desk. Commentary includes a comprehensive “deep dive” with optics on the day’s investment-grade corporate debt new issuance and secondary market data encompassing among other items, comparables, investment-grade credit spreads, new issue activity, secondary market most active issues, and upcoming deal pipeline. To receive Quigley’s Corner, please email: rquigley@mischlerfinancial.com or via phone 203.276.6646