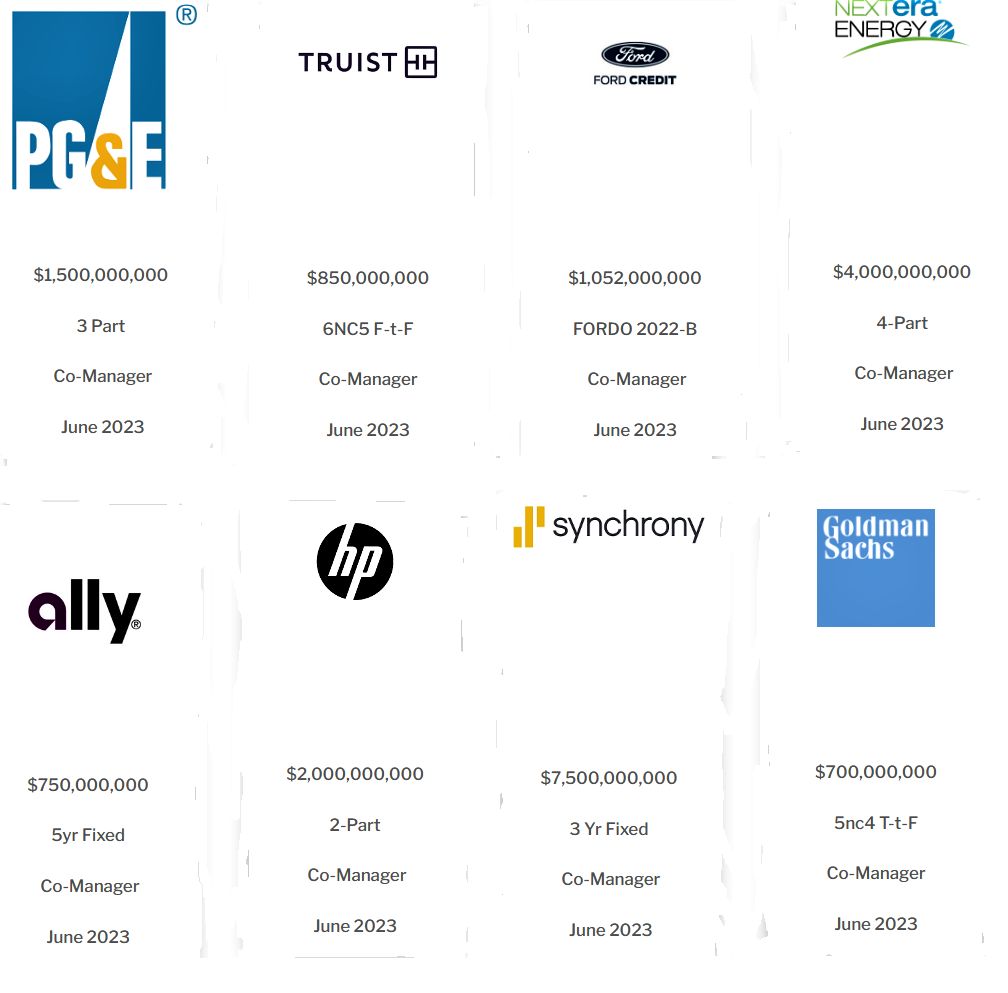

The month of June enjoyed a bloom of IG Corporate Bond issuance, and Mischler was front and center in the course of co-manager mandates awarded by Ally Financial, Goldman Sachs, Hewlett Packard Inc., Ford Motor Credit, NextEra Energy, Truist, PG&E, and Synchrony Financial.

In aggregate, Mischler Financial Group’s debt capital markets team served as co-manager by assisting the above eight corporate debt issuers in the course of their floating a total of $18.3bil (notional value) in new bonds, and with an average over-subscription rate of 3.8x the firm’s underwriting liability.