Investment-grade corporate debt issuance during the last two months of Q3 2023 will best be remembered as a continuation of a higher-for-longer interest rate regime, during which Fortune CFOs and their treasury teams grappled with “go, no-go” decisions. Suffice to add, Jay Powell, the Federal Reserve Chairman, remained consistent in his September messages, as he has since the beginning of 2023; “interest rate decisions remain data dependent”, “we will stay tight as long as inflation remains sticky”, and perhaps his most poignant remarks pointed to “we will pause for the moment, (yet) there is no reason for market participants (or pundits) to infer that we will be cutting rates in the near or intermediate term.”

With that backdrop, IG issuers from across industrial, utility, and financial sectors remained diligent and disciplined; with many issuing new bonds simply to replace maturing debt (vs. outright adding debt to balance sheets). Convertible debt issuance continued to prove a more attractive option among a cohort of IG companies (as interest rates offered on converts impose less of a burden on cash flow).

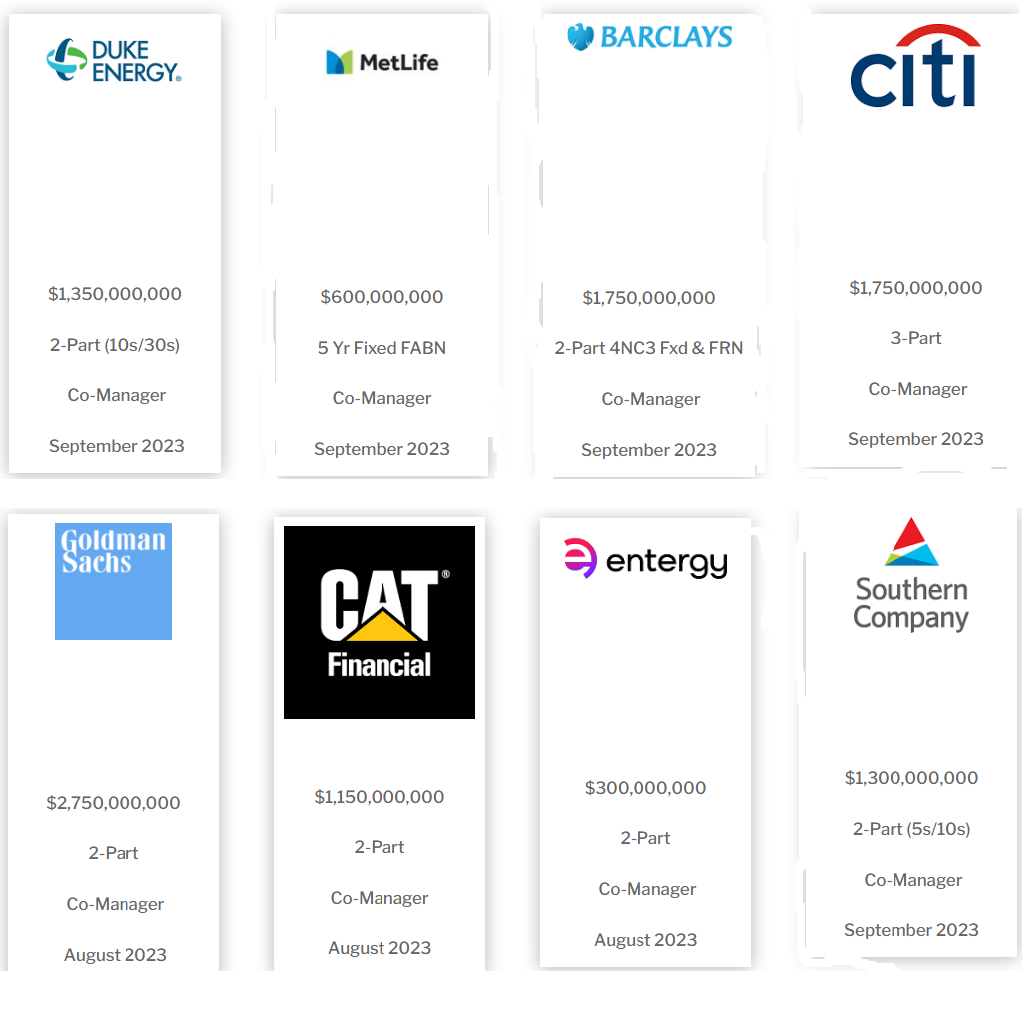

Throughout August and September, veteran-owned and operated Mischler Financial Group’s DCM team welcomed the opportunity to assist Caterpillar Financial, Duke Energy, Entergy, Southern Company, Barclays, Citigroup, Goldman Sachs, and Met Life in the course of their issuing a total of $10.75bil (notional) debt.