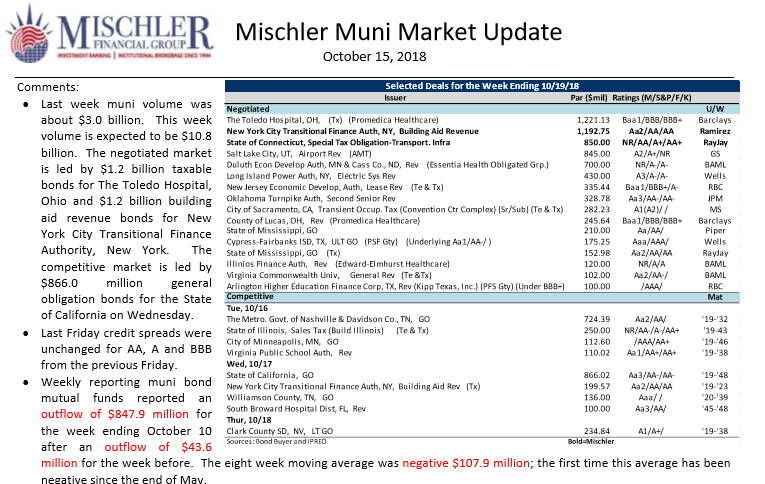

New Muni Market Debt Offerings Scheduled for Week of October 15, 2018- Last week muni volume was about $3.0 billion. This week volume is expected to be $10.8 billion. The negotiated market is led by $1.2 billion taxable bonds for The Toledo Hospital, Ohio and $1.2 billion building aid revenue bonds for New York City Transitional Finance Authority, New York. The competitive market is led by $866.0 million general obligation bonds for the State of California on Wednesday.

As always, the Mischler Muni Market Outlook provides public finance investment managers, institutional investors focused on municipal debt and muni bond market participants with a summary of the prior week’s municipal bond market activity, including credit spreads and money flows, and a look at pending municipal finance offerings tentatively scheduled for the most current week.

Below and attached is neither a recommendation or offer to purchase or sell securities. Mischler Financial Group is not a Municipal Advisor. For additional information, please contact Managing Director Richard Tilghman at 203.276.6676.

During first half of 2018, and full years 2017 and 2016 alone, minority broker-dealer Mischler Financial Group Inc. underwriting roles (for which MFG has led, co-managed and/or served as selling group member) have included more than $625 Billion (notional value) in new debt and preferred shares issued by Fortune corporations, as well as debt issued by various municipalities and US Government agencies.

Mischler Financial Group is the securities industry’s oldest minority broker-dealer owned and operated by Service-Disabled Veterans. Mischler is also a federally-certified Service-Disabled Veteran-Owned Business Enterprise (SDVOBE). Mischler Muni Market updates and Municipal Debt New Issuance outlooks are provided as a courtesy to institutional clients of Mischler Financial Group, Inc.

This document may be not reproduced in any manner without the permission of Mischler Financial Group. Although the statements of fact have been obtained from and are based upon sources Mischler Financial Group believes reliable, we do not guarantee their accuracy, and any such information may be incomplete. All opinions and estimates included in this report are subject to change without notice. This report is for informational purposes and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Veteran-owned broker-dealer Mischler Financial Group, its affiliates and their respective officers, directors, partners and employees, including persons involved in the preparation of this report, may from time to time maintain a long or short position in, or purchase or sell a position in, hold or act as market-makers or advisors or brokers in relation to the securities (or related securities, financial products, options, warrants, rights, or derivatives), of companies mentioned in this report or be represented on the board of such companies. Neither Mischler Financial Group nor any officer or employee of Mischler Financial Group or any affiliate thereof accepts any liability whatsoever for any direct, indirect or consequential damages or losses arising from any use of this report or its contents.

Regarding above-noted Toledo Hospital of Ohio debt offering, the information and expressions of opinion in the preliminary offering memorandum dated October 3, 2018 for The Toledo Hospital Taxable Bonds, Series 2018B (ProMedica Healthcare Obligated Group) (the “Preliminary Offering Memorandum”) are subject to change without notice. The availability of the Preliminary Offering Memorandum on this website does not create any implication that there have been no changes in the affairs of the parties described in the Preliminary Offering Memorandum or that the other information or opinions therein are correct as of any time subsequent to its date. Maintenance of the Preliminary Offering Memorandum on this website is not intended as a republication of the information therein on any date subsequent to the date set forth in the Preliminary Offering Memorandum.

The Preliminary Offering Memorandum was created in Adobe Portable Document Format (PDF). Using software other than Adobe Reader 8.0 or higher, may cause the document that you view or print to differ from the document as it was posted on this website or as it appears in the printed version, and you assume the risk of any such discrepancies as well as any discrepancies related to communication transmission or other printing problems. If you do not have Adobe Acrobat Reader or if you are using a version of Adobe Reader that is earlier than Adobe Acrobat 8.0, you may obtain an updated version free of charge from Adobe website at www.adobe.com.

Under no circumstances shall the Preliminary Offering Memorandum or its electronic posting constitute an offer to sell or the solicitation of any offer to buy nor will there be any sale of the securities described in the Preliminary Offering Memorandum in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

Investors must read the entire Preliminary Offering Memorandum, including the appendices, to obtain information essential to making an informed investment decision.

By electronically accessing the Preliminary Offering Memorandum, you acknowledge that you understand that the securities are being offered only by means of the entire Preliminary Offering Memorandum and agree that you have (i) accepted the provisions of this page, (ii) agreed not to print the Preliminary Offering Memorandum except in its entirety and (iii) consented to the electronic transmission of the Preliminary Offering Memorandum.

New Muni Market Debt Offerings Scheduled for Week of October 15, 2018-