With 2023 firmly underway, corporate debt issuers have found the markets more than welcoming to new offerings.

With 2023 firmly underway, corporate debt issuers have found the markets more than welcoming to new offerings.

As observed by Rob Karr, Mischler Financial Group’s Head of Capital Markets, “January was a trifecta month; spreads are tighter, total returns for IG bonds approached 4%, and January new issuance volume for IG was robust.”

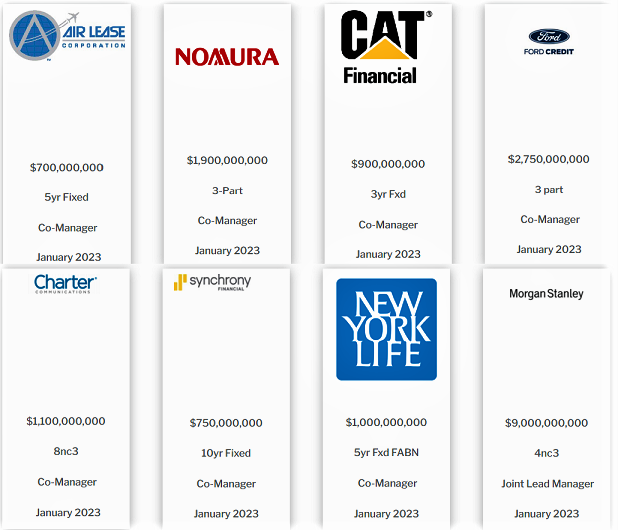

Mischler Financial Group’s DCM team participated as a co-manager in eight major transactions, representing $18.5b (notional). Issuers that selected Mischler to participate in underwriting consortiums included Air Lease Corp., Caterpillar Financial, Charter Communications, Ford Motor Credit, Morgan Stanley, Nomura Holdings, and Synchrony Financial.