by Mischler MarCom | Oct 31, 2018 | Debt Market Commentary

Quigley’s Corner 10.31.18- Investment Grade Issuance: Trick or Treat? Investment Grade New Issue Re-Cap: Now Focused on November Corporate Debt Issuance. Today’s IG Primary & Secondary Market Talking Points Syndicate IG Corporate-only Volume Estimates for This...

by Mischler MarCom | Oct 31, 2018 | Company News, Giving Back, News and Information

Newport Beach, CA & Stamford, CT – November 1, 2018 — Each year, Mischler Financial Group, Inc. (“Mischler”), the securities industry’s oldest investment bank and institutional brokerage owned and operated by service-disabled veterans, pledges a...

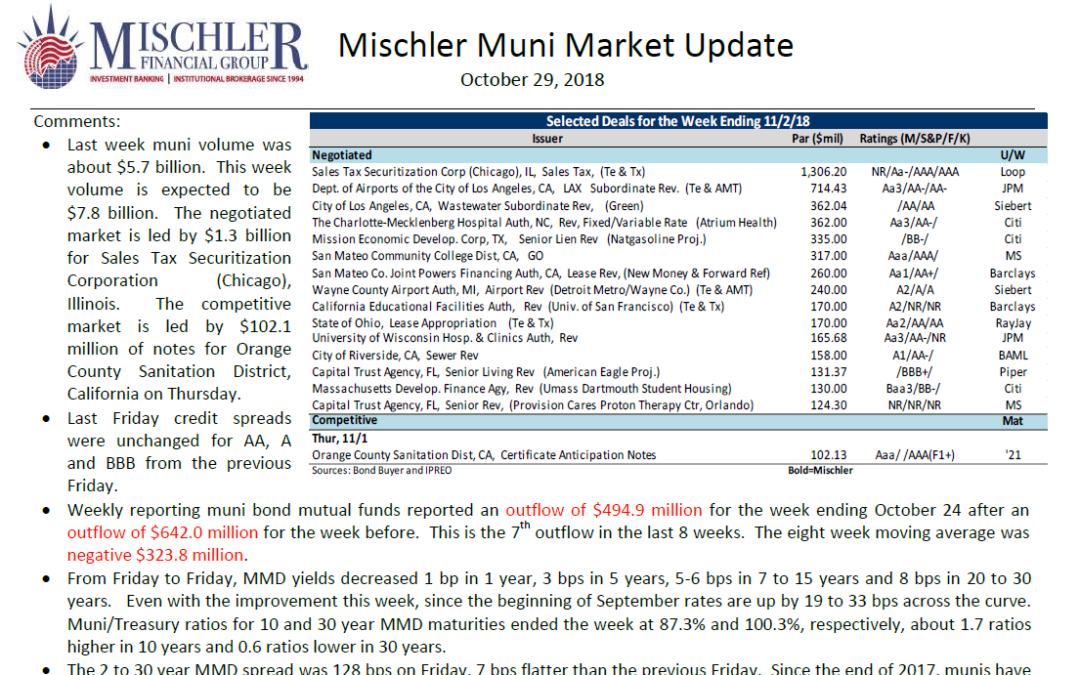

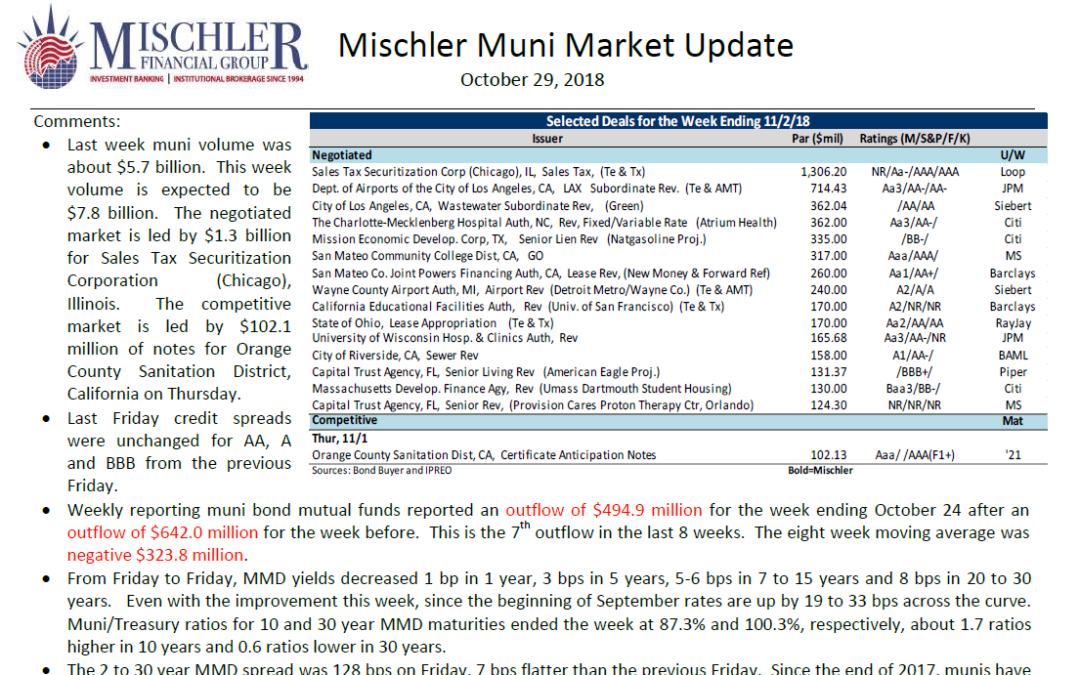

by Mischler MarCom | Oct 29, 2018 | Muni Market

Muni Market Debt Offerings Scheduled for Week of October 29, 2018- Mischler Muni Market Outlook provides public finance investment managers, institutional investors focused on municipal debt and muni bond market participants with a summary of the prior week’s...

by Mischler MarCom | Oct 22, 2018 | Debt Market Commentary

“Quigley’s Corner” 10.22.18 Constellation Brands Bonds, Beer & Bongs Investment Grade Corporate Bonds New Issue Re-Cap Constellation Brands Creates a Primary Market “High” Today’s IG Primary & Secondary Market Talking Points Syndicate IG Corporate-only Volume...

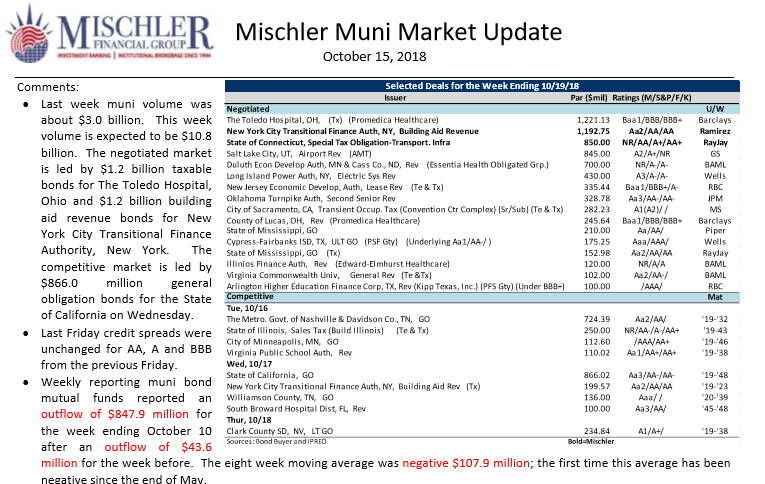

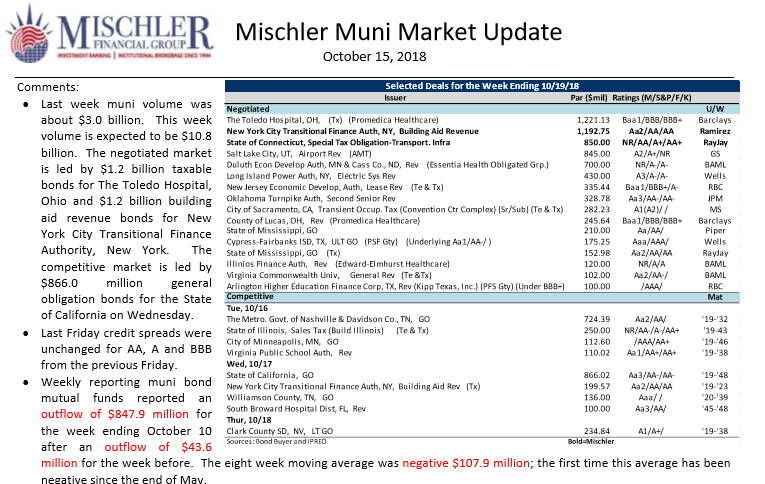

by Mischler MarCom | Oct 15, 2018 | Muni Market

New Muni Market Debt Offerings Scheduled for Week of October 15, 2018- Last week muni volume was about $3.0 billion. This week volume is expected to be $10.8 billion. The negotiated market is led by $1.2 billion taxable bonds for The Toledo Hospital, Ohio and $1.2...