Debt Market Commentary

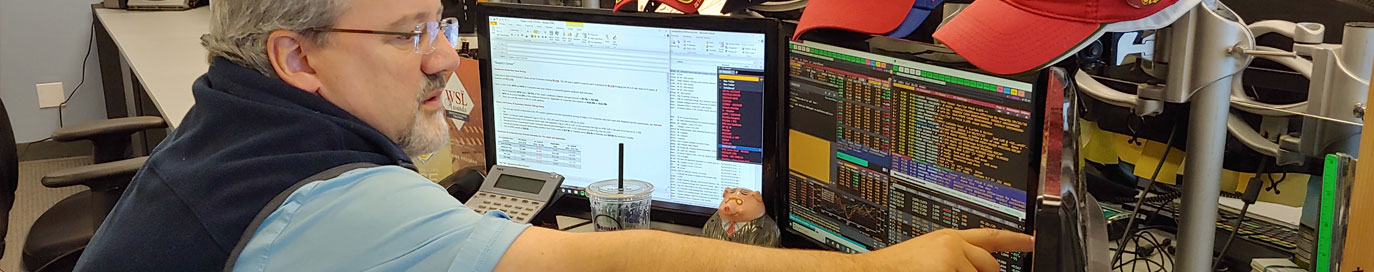

Daily analysis of primary DCM Investment Grade & HY Corporate Debt activity distributed under the banner “Quigley’s Corner” to Fortune corporate treasury teams, asset managers who rely on Mischler, and Wall Street’s top fixed income syndicate desks. Insight includes a deep dive into the metrics of the day’s noteworthy new issuance, pending debt offerings, rates trading markets, and prospective M&A activity.

Mischler Financial and BlackRock to Partner to Provide Dedicated Cash Management Share Class

New York, 28 September 2020 – BlackRock is pleased to announce, in partnership with Mischler Financial Group (“Mischler”), a leading disabled veteran-owned broker dealer, that registration statements for Mischler Financial Group Shares, a dedicated share class for...

Mischler Co-Manages Coca-Cola €2.6b 3-Part Debt Deal-Everything is Better When We’re Open!

Mischler Financial Group -As Best Said by Coca-Cola, "Everything is Better When We're Open!" Below is excerpted from the September 14, 2020, edition of Quigley’s Corner, Mischler Financial Group’s daily debt market coverage and commentary distributed to Fortune 500...

Duke Energy Further Advances Diversity; Enlists Minority-Owned BDs in Latest Debt Deal

Duke Energy Progress LLC $700m Debt Offering Counts Diversity-Certified Mischler Financial Group Among Deal's Co-Managers; Investment Grade New Issues Make New All-Time Record Below is excerpted from Aug 17 2020 edition of Quigley’s Corner, Mischler Financial Group’s...

Alphabet Inc Owns the A’s, B’s and C’s of Today’s IG Dollar DCM

Alphabet Inc. $10b 6-part Debt Issuance Makes GOOG the Top Issuer of the Day Below is excerpted from Aug 03 2020 edition of Quigley’s Corner, Mischler Financial Group’s daily debt market coverage and commentary distributed to Fortune 500 treasury teams, leading...

IG Corporate Debt Market Talking About AT&T-$11b 5-Part Senior Notes

Below is excerpted from July 27 edition of Quigley's Corner, Mischler Financial Group's daily debt market coverage and commentary distributed to Fortune 500 treasury teams, leading institutional investors, and the sell-side's most recognized fixed income syndicate...

Mischler Co-Manages $1bil Ford Foundation Social Bond Offering

Ford Foundation Social Bond Offering Reflects Historic, Unprecedented Action to Increase Grantmaking for Nonprofits by $1 Billion with Proceeds of Offering of Social Bonds in Response to COVID-19 The Ford Foundation's Social Bonds, Series 2020 (taxable) are comprised...

Comcast Debt Offering Glimmers in $12.6bn Day for IG New Issuance

Today's $4bn, 3-part senior notes debt offering from Comcast Corp. capped a $12.6bn day in IG new issuance. Toyota Motor Credit Corp (TMCC) sold $3bn in a 3-part offering of senior notes, both transactions co-managed by Mischler Financial Group. Below is excerpted...

IG Corporate Debt Issuance: Lockheed Martin-Your Mission is Our Mission

Lockheed Martin Corp. (NYSE:LMT) Issues $1.15bn in 2-Part Senior Notes Transaction. Mischler Financial Serves as Active Co-Manager. Hence, Your Mission is Our Mission! Below is excerpted from today’s edition of Quigley’s Corner, authored and published by Ron Quigley,...

IG Corporate Debt Market: $25b New Issuance Led by Disney: The Magic Kingdom

$25.7b in new IG Corporate Debt Issuance to start the week; Led by $11b Walt Disney Co.; IG Corporate Bond New Issues are The New Magic Kingdom Below is excerpted from today’s edition of Quigley’s Corner, authored and published by Ron Quigley, Mischler Financial Group...

AIG Awards Mischler Active Co-Manager Role for $4.1b Senior Notes Deal

AIG Inc’s. $4.1b 3-Part 5-, 10- and 30-year Senior Notes New Issue Embraced by Fixed Income Investors; Day's IG Debt Issuance Tops $28.6b from 15 Issuers Below is excerpted from today’s edition of Quigley’s Corner, authored and published by Ron Quigley, Mischler...

Boeing Lands $25b 7-Part Debt Offering; Mischler Co-Manager

Boeing Company's $25b 7-part Debt Offering Flies High, Wind in the Sail for a $300b Month for IG Corporate Debt Markets; all-time monthly record. Quigley’s Corner 04-30-2020 : Investment Grade New Issues – IG Corporate-only DCM Breaks Thru $300b for April. Boeing’s...

General Electric Company Issues a $6b 4-part Debt Deal; Mischler Active Co-Manager

Quigley’s Corner 04-13-2020: General Electric Company Issues a $6b 4-part 7-, 10-, 20 and 30-year; Mischler Named Active Co-Manager Below is excerpted from today’s edition of Quigley’s Corner, authored and published by Ron Quigley, Mischler Financial Group Managing...

Ameren Corp. & Visa Inc. Upsize Debt Offerings; QC 03-31-20

IG Corporate Primary & Secondary Market Talking Points – Mischler on Ameren Corp. long 10-year and $4b 3-part Visa Inc Below is excerpted from the 03-31-20 edition of "Quigley’s Corner", authored and published by Ron Quigley, Mischler Financial Group Managing...

Confronting COVID-19 Requires Confidence

As American Patriot and Philosopher Thomas Paine wrote in 1776, "These are the times that try men's souls.." COVID-19 has touched too many of those we know and has stoked fear and anxiety about the health and economic safety of loved ones and friends. And, as all of...

Investment Grade Corporate Debt Issuers Confound COVID-19

Quigley's Corner 03-27-20: Investment Grade New Issuance Surmount COVID-19 Below is excerpted from today’s edition of Quigley’s Corner, authored and published by Ron Quigley, Mischler Financial Group Managing Director & Head of Fixed Income Syndicate Investment...

Primary Debt Capital Markets

1000+Offerings | 230+ Issuers | $2 Trillion+

Investment Grade | High Yield Corporate

Municipal Debt | Agency Debt | Structured Products

Primary & Secondary Equity Capital Markets

230+ Initial Public Offerings

175+ Follow-on Offerings (115 Issuers)

Better Execution

10b-18 | 10b5-1 Broker Rotation Schedules

US Equities | ETFs | International Equities

949.720.0640

949.720.0640 800.820.0640

800.820.0640