by Mischler MarCom | Oct 22, 2018 | Debt Market Commentary

“Quigley’s Corner” 10.22.18 Constellation Brands Bonds, Beer & Bongs Investment Grade Corporate Bonds New Issue Re-Cap Constellation Brands Creates a Primary Market “High” Today’s IG Primary & Secondary Market Talking Points Syndicate IG Corporate-only Volume...

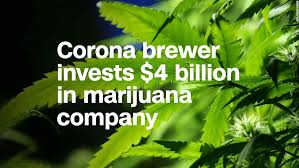

by Mischler MarCom | Oct 15, 2018 | Muni Market

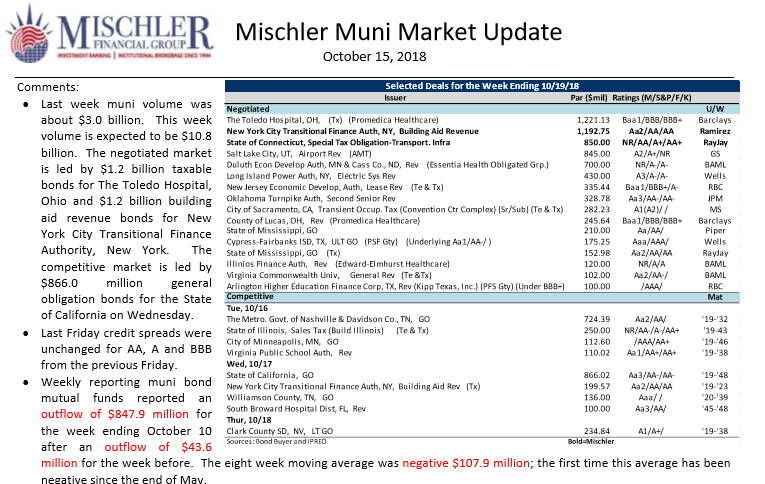

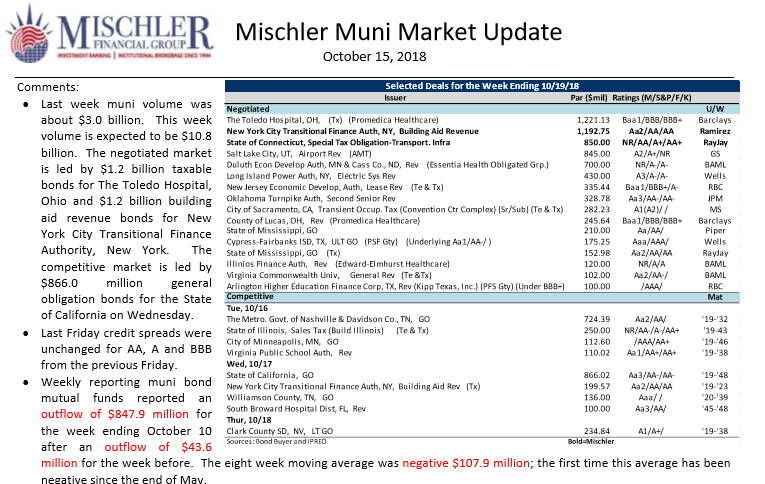

New Muni Market Debt Offerings Scheduled for Week of October 15, 2018- Last week muni volume was about $3.0 billion. This week volume is expected to be $10.8 billion. The negotiated market is led by $1.2 billion taxable bonds for The Toledo Hospital, Ohio and $1.2...

by Mischler MarComm Team | Sep 21, 2018 | Recent Deals

Mischler Financial Group Inc. Serves as Co-Manager for $500 million in green bonds issued by Alliant Energy Corp. subsiidary Interstate Power & Light MADISON, Wis., Sept. 20, 2018 /PRNewswire/ — Interstate Power and Light Company (“IPL”), a wholly owned subsidiary...

by Mischler MarComm Team | Aug 13, 2018 | Muni Market, Recent Deals

Municipal Debt Market Sees Highest Volumes for Year; New Muni Debt Offerings Scheduled Week of August 13 2018-With last week’s muni debt secondary market volume setting a record for the year, new muni bond issues scheduled for issuance this week is expected to be...

by Mischler MarComm Team | Aug 7, 2018 | Muni Market, News and Information

New Municipal Debt Offerings Scheduled Week of Aug 6, 2018…Mischler Muni Market Update looks back to last week’s muni bond issuance, municipal bond fund flow metrics and a focused lens on the muni bond new offerings for this week. As always, the Mischler Muni Market...