Muni Bond New Issuance Scheduled Week of Jan 02 2018 via Mischler Muni Market Update looks back to last week’s metrics and provides view towards municipal bond offerings scheduled for this holiday-shortened week. Between two back-to-back

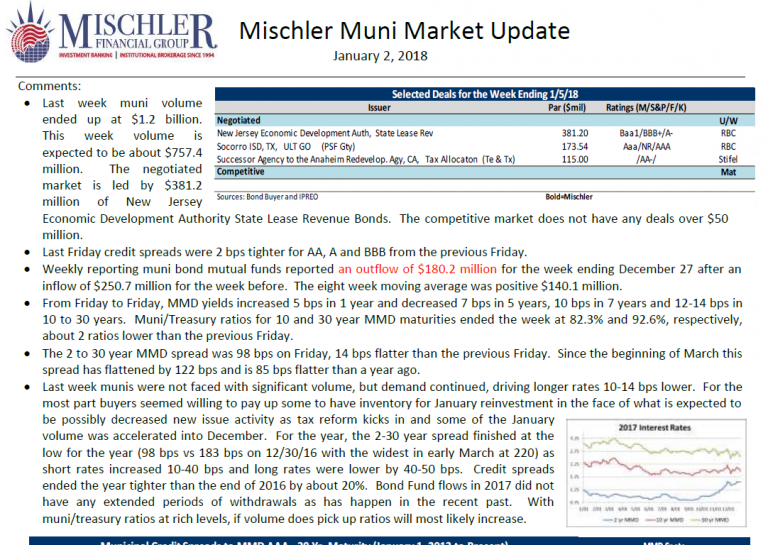

Last week muni volume ended up at $1.2 billion. This week volume is expected to be about $757.4 million. The negotiated

Below and attached is neither a recommendation or offer to purchase or sell securities. Mischler Financial Group is not a Municipal Advisor. For additional information, please contact Managing Director Richard Tilghman at 203.276.6656

For reading ease, please click on

Since 2014 alone, minority broker-dealer Mischler Financial Group Inc.’s presence across the primary Primary Debt Capital Markets (DCM) space has included underwriting roles in which Mischler has led, co-managed and/or served as selling group member for more than $600 Billion (notional value) in new debt and preferred shares issued by Fortune corporations, as well as debt issued by various municipalities and US Government agencies.

Mischler Financial Group is the securities industry’s oldest minority broker-dealer owned and operated by Service-Disabled Veterans. Mischler is also a federally-certified Service-Disabled

This document may be not reproduced in any manner without the permission of Mischler Financial Group. Although the statements of fact have been obtained from and are based upon sources Mischler Financial Group believes reliable, we do not guarantee their accuracy, and any such information may be incomplete. All opinions and estimates included in this report are subject to change without notice. This report is for informational purposes and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Veteran-owned broker-dealer Mischler Financial Group, its affiliates and their respective officers, directors, partners and employees, including persons involved in the preparation of this report, may from time to time maintain a long or short position in, or purchase or sell a position in, hold or act as market-makers or advisors or brokers in relation to the securities (or related securities, financial products, options, warrants, rights, or derivatives), of companies mentioned in this report or be represented on the board of such companies. Neither Mischler Financial Group nor any officer or employee of Mischler Financial Group or any affiliate thereof accepts any liability whatsoever for any direct, indirect or consequential damages or losses arising from any use of this report or its contents.