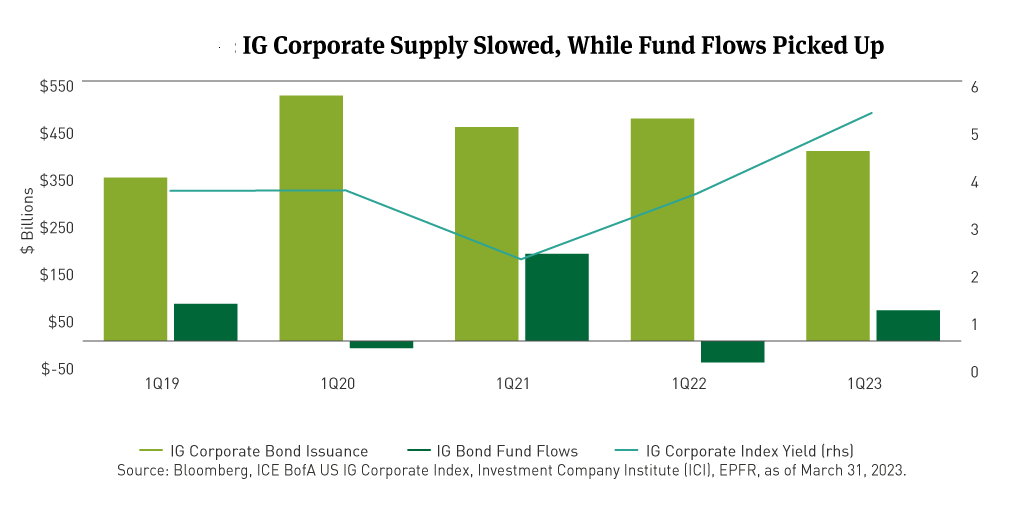

The market for investment grade debt new issuance, though not as robust as 2022, has proven resilient since the beginning of 2023, despite Issuer and investor concerns about the economic outlook and uncertainty as to how much longer interest rates might remain higher.

Following a relatively robust February, during which investment grade corporate issuers brought $144bil in new offerings to the market as corporate treasurers focused on staying ahead of prospective further tightening of credit conditions and higher borrowing costs, investment grade corporate debt issuance during the month of March dipped somewhat, to $100bil; a month-over-month drop that was greatly attributable to a US regional banking crisis instigated by the back-to-back failures of Silicon Valley Bank, and days later, Signature Bank.

Following a relatively robust February, during which investment grade corporate issuers brought $144bil in new offerings to the market as corporate treasurers focused on staying ahead of prospective further tightening of credit conditions and higher borrowing costs, investment grade corporate debt issuance during the month of March dipped somewhat, to $100bil; a month-over-month drop that was greatly attributable to a US regional banking crisis instigated by the back-to-back failures of Silicon Valley Bank, and days later, Signature Bank.

Though new corporate debt issuance is down slightly when compared to 2022, replacing maturing debt, even at higher rates remains a prevalent component of corporate balance sheet maintenance. Top-tier Fortune corporations have continued to demonstrate their abilities to confront inflation headwinds while Pandemic-related supply-chain obstacles have eased. Corporate earnings reported throughout Q1 have surpassed Wall Street analysts’ expectations, and at the same time, Fortune treasury teams have proven their belt-tightening prowess. The YoY drops in debt issuance is reflective of responsible management; no noticeable increase in debt, merely re-funding issues that are maturing.

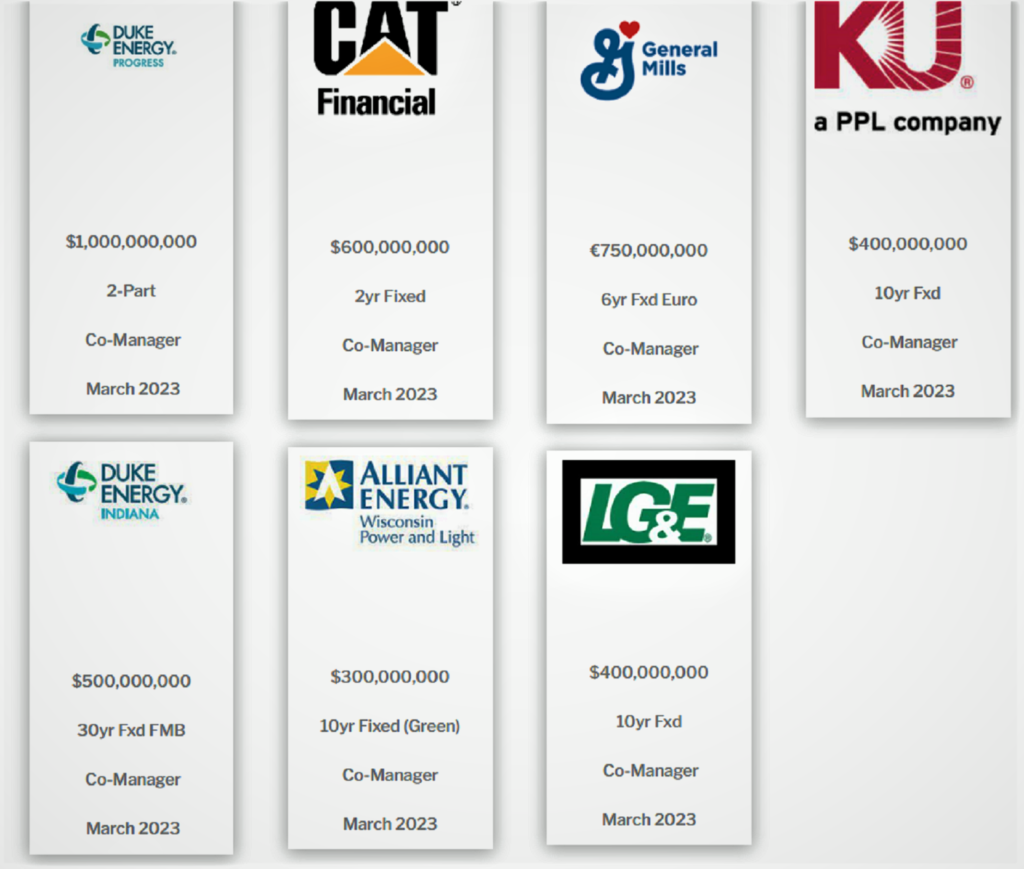

To the above, industrial and utility titans that include Caterpillar Financial, General Mills, Duke Energy, Kentucky Utilities, Lousianna Gas & Electric, and Alliant Energy each mandated veteran-owned broker-dealer Mischler Financial Group’s debt capital markets team play an underwriting consortium role in deals that brought $4bil notional in debt offerings to institutional investors during the month of March.

To the above, industrial and utility titans that include Caterpillar Financial, General Mills, Duke Energy, Kentucky Utilities, Lousianna Gas & Electric, and Alliant Energy each mandated veteran-owned broker-dealer Mischler Financial Group’s debt capital markets team play an underwriting consortium role in deals that brought $4bil notional in debt offerings to institutional investors during the month of March.