Debt Market Commentary

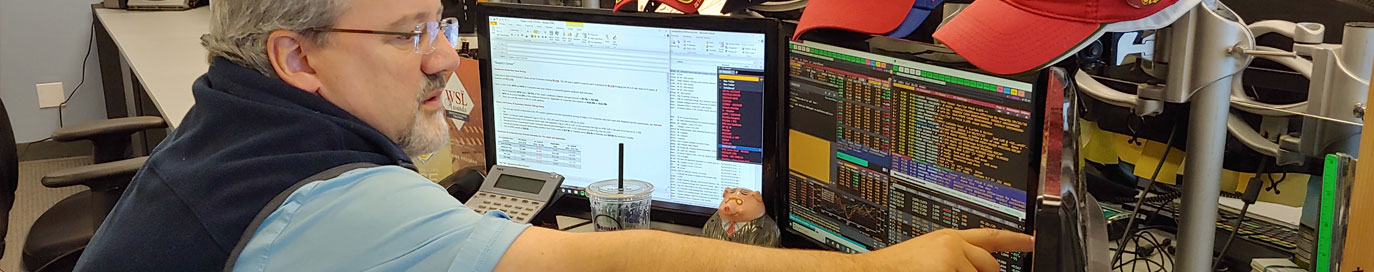

Daily analysis of primary DCM Investment Grade & HY Corporate Debt activity distributed under the banner “Quigley’s Corner” to Fortune corporate treasury teams, asset managers who rely on Mischler, and Wall Street’s top fixed income syndicate desks. Insight includes a deep dive into the metrics of the day’s noteworthy new issuance, pending debt offerings, rates trading markets, and prospective M&A activity.

May Flowers: Mischler Serves as Co-Manager for $24bil IG New Issuance

Following a tepid April for investment grade corporate bond new issuance overall, those April showers turned to May flowers for veteran-owned investment bank Mischler Financial Group. Working on behalf of Citigroup, Caterpillar Inc., McKesson Corp., HSBC US, HSBC...

Banks Bank On April-Mischler IG Debt Offerings: $26.25bil

April 2025 was "Bank Month" for Mischler Financial Group's IG Corporate Debt Syndicate Desk. Serving as co-manager on five 'big bank' underwritings, Team Mischler was selected to assist in the placement of $26.25bil [aggregate] for Bank of America $BAC ($3bil...

Veteran-Owned Mischler Financial Group Welcomes Former J.P. Morgan Executive as Debt Markets Managing Director

Veteran-Owned Mischler Financial Group Welcomes Former J.P. Morgan Executive as Managing Director, Debt Capital Markets Newport Beach, CA, and Stamford, CT – January 10, 2025 – Mischler Financial Group, Inc. (“Mischler”), the nation’s oldest diversity-certified...

Mischler Special Advisor HR McMaster: Post-Election Geostrategic Sitrep Nov 15 2024

This past Friday (November 15), LTG H.R. McMaster, the nation’s 25th National Security Advisor, and now Special Advisor to Mischler Financial Group, sat down with Mischler CEO & Principal Dean Chamberlain for a special “Geostrategic SITREP” that is designed to...

Mischler Financial Special Advisor HR McMaster Exclusive Geopolitical SITREP: Israel Attacked

Q3 Investment Grade Corporate Debt Issuance Concludes-Mischler Reports

Investment-grade corporate debt issuance during the last two months of Q3 2023 will best be remembered as a continuation of a higher-for-longer interest rate regime, during which Fortune CFOs and their treasury teams grappled with "go, no-go" decisions. Suffice to...

Mischler Exec Leads Discussion at Illinois State Treasurer’s 8th Annual Diversity in Investments Forum

September 21, 2023- This year's Illinois State Treasurer's Annual Diversity in Investments Forum, an event that attracts financial industry thought-leaders from around the country to share thoughts on diversity, equity, and inclusion best practices, had Mischler...

Best Practices When Selecting Diversity-Certified Broker-Dealers

July IG Corporate Debt Issuance: One Hot Summer for Big Bank Bond Offerings

As temperatures flared across the United States, making it the hottest July on record, IG Corporate Debt Issuance heated up for the third straight month in a row, with approximately $90bil of new issuance. Despite the heat, veteran-owned and operated Mischler...

June Blooms for IG Corporate Bond Issuance-Mischler Debt Capital Mkts

The month of June enjoyed a bloom of IG Corporate Bond issuance, and Mischler was front and center in the course of co-manager mandates awarded by Ally Financial, Goldman Sachs, Hewlett Packard Inc., Ford Motor Credit, NextEra Energy, Truist, PG&E, and Synchrony...

May Flowers: Mischler Co-Manages $12bil in IG Corporate Debt Issuance

For those who embrace "April showers bring May flowers", that adage held true for the IG corporate debt market. Participating in the uptick of new issuance from April, diversity-certified broker-dealer Mischler Financial Group's debt capital markets team served as...

Mischler Primary Debt Capital Markets Jan 2023 Scorecard: 8 Deals, $18.5bil New Issuance

With 2023 firmly underway, corporate debt issuers have found the markets more than welcoming to new offerings. As observed by Rob Karr, Mischler Financial Group's Head of Capital Markets, "January was a trifecta month; spreads are tighter, total returns for IG bonds...

October IG Debt Issuance: Mischler Plays Roles in $22bil New Offerings

During the month of October 2022, Mischler Financial Group, the nation's oldest diversity-certified broker-dealer owned & operated by military veterans (SDVOBE & MBE) served eight leading investment grade corporate debt issuers in the course of assisting the...

Mischler On Board For Union Pacific 3-Part Senior Notes Offering

Mischler Financial Group's Debt Capital Markets Team On Board For Union Pacific $1.9b 3-Part Senior Notes Offering The nation's second-largest North American railroad in terms of both revenue and volume and one that controls almost all of the rail-based shipping in...

Federal Farm Credit Banks Funding Corp Adds Mischler to LEAD Dealer Group

FEDERAL FARM CREDIT BANKS FUNDING CORPORATION ANNOUNCES THE ADDITION OF MISCHLER FINANCIAL GROUP, INC.TO THE LEAD (Leveraging Equality and Diversity) DEALER ™ BOND AND DISCOUNT NOTE SELLING GROUP News Release-Monday August 29, 2022 JERSEY CITY, NJ – The Federal...

Primary Debt Capital Markets

1000+Offerings | 230+ Issuers | $2 Trillion+

Investment Grade | High Yield Corporate

Municipal Debt | Agency Debt | Structured Products

Primary & Secondary Equity Capital Markets

230+ Initial Public Offerings

175+ Follow-on Offerings (115 Issuers)

Better Execution

10b-18 | 10b5-1 Broker Rotation Schedules

US Equities | ETFs | International Equities

949.720.0640

949.720.0640 800.820.0640

800.820.0640