Debt Market Commentary

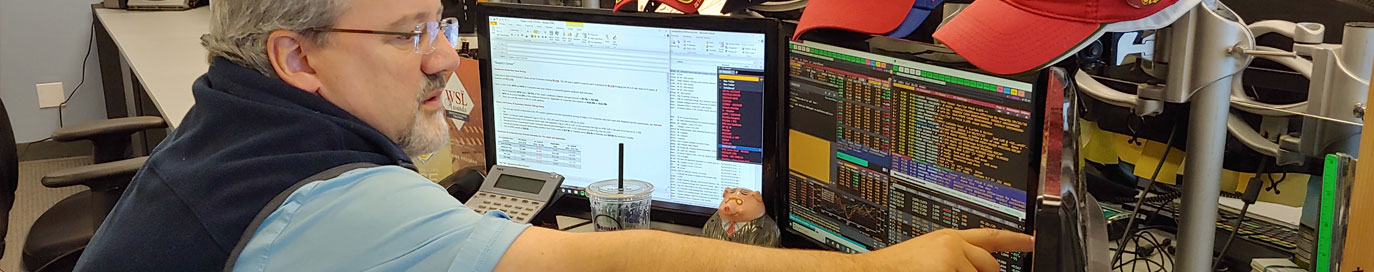

Daily analysis of primary DCM Investment Grade & HY Corporate Debt activity distributed under the banner “Quigley’s Corner” to Fortune corporate treasury teams, asset managers who rely on Mischler, and Wall Street’s top fixed income syndicate desks. Insight includes a deep dive into the metrics of the day’s noteworthy new issuance, pending debt offerings, rates trading markets, and prospective M&A activity.

No Summer Slowdown for Corporate Debt Issuance-Mischler

Corporate debt issuance for the month of August remained resilient, despite the pervasive widening in the yield curve and recessionary concerns spreading across the credit markets. To the above, Mischler Financial Group's debt capital markets team did not have the...

Mischler Trifecta First Week of August Primary DCM: Intel, HSBC & Barclays

Mischler Financial Group's Primary DCM Team scored a Trifecta during the first week of August with (3) Active Co-Manager underwriting roles on behalf of issuers Intel Corp,, HSBC Holdings plc and Barclays plc. In aggregate, these issuers raised $12.75bil. Aug 2nd's...

Alameda County Adds Mischler Financial Group for Cash Management Mandate

Inaugural investment to be allocated to the Mischler dedicated share class for the BlackRock Liquid Federal Trust Fund (EDUXX) Newport Beach, CA & Stamford, CT, June 29, 2022-The Alameda County Investment Pool has allocated an undisclosed amount in an inaugural...

Mischler Joins Tradeweb Electronic Bond Trading Dealer Diversity Program

Tradeweb Markets Inc. Launches Spotlight Dealer Diversity Program to Promote Greater Institutional Customers' Use of Minority Broker-Dealers June 23, 2022- Mischler Financial Group, Inc., the sell-side's oldest diversity-certified broker-dealer owned and operated by...

Mischler 2022 Memorial Day Month Pledge: Good360 Ukraine Relief Program & New York’s ASPIRA

Mischler Financial Group Aligns with Good360 for Veteran-Owned Investment Bank’s 2022 Memorial Day Month Pledge to Benefit Ukraine Refugees and New York’s ASPIRA Newport Beach, CA and Stamford, CT, May 23, 2022 -Mischler Financial Group, the nation’s oldest...

Mischler Presents to California Municipal Treasurers Annual Conference

Team Mischler is honored that the California Municipal Treasurers Association (CMTA) invited our Director of Debt Capital Markets, Jason Klinghoffer, CFA, the creator of the portfolio MaxQ Analytics platform (and a US Marine Corps Veteran) to provide a special...

Mischler Geostrategic Risk Sitrep Mar 16 HR McMaster-Wilson Sonsini Partner Beth George

Mar 16 2022, Silicon Valley area clients of Mischler Financial Group participated in a Geostrategic Risk & Global Techsec SITREP, with special guest speakers Mischler Special Advisor LTG H.R. McMaster (Ret) and Beth George, Esq., Wilson Sonsini partner, Head of...

Protected: H.R. McMaster 02-24-2022 Mischler Special Advisor Russia-Ukraine Crisis Sitrep

Password Protected

To view this protected post, enter the password below:

Diversity Investment Banks Role in Debt Capital Markets-Leadership Profile

Diversity-certified investment banks' role in primary debt capital markets; profiled by Senior Bonds Editor for Informa Global Markets Shankar Ramakrishnan via an interview with Dean Chamberlain, CEO Mischler Financial Group [video width="640" height="360"...

Mischler Adds Two More Seasoned Debt Capital Markets Veterans

Mischler, Nation’s Oldest Diversity-Certified Investment Bank Owned & Operated by Military Veterans Adds Two More Seasoned Capital Market Professionals Stamford, CT, June 29, 2021–Mischler Financial Group, Inc. (“Mischler”), the financial industry’s oldest...

Former National Security Advisor Lt. General H.R. McMaster (Ret.) Now a Special Advisor to Veteran-Owned Investment Bank Mischler Financial Group, Inc.

Stamford, CT, Dec 03, 2020 – Mischler Financial Group, Inc., the oldest diversity-certified broker-dealer owned and operated by military veterans, today announced the appointment of Lt. General Herbert Raymond “H.R.”. McMaster (Ret.), a Hoover Institution Senior...

The Speculation Miscalculation: Don’t Beat the Market, Be the Market

Mischler's Director of Debt Capital Markets, Jason Klinghoffer, CFA, and former US Marine presents a Call on Callables webinar to the Government Investment Officers Association (GIOA) Timing the Market vs. Dynamic Allocations Anchoring and Adjustment Bias (cognitive)...

New York Fed Selects Mischler Financial Group For SMCCF and CMBS Programs

New York Fed Selects Mischler Financial Group to Support SMCCF and Becomes Approved Counterparty for Open Market Agency CMBS program October 26, Stamford, CT- The Federal Reserve Bank of New York has announced that diversity-certified investment bank and institutional...

PepsiCo Inc. Floats Inaugural D&I Debt Issuance-That’s What (We) Like!

Investment Grade New Issues: PepsicCo Inc. Prices D&I Debt Issue; SDV Owned & Operated Mischler Financial Group is a Joint Lead, along with (7) other diversity-certified investment banks. Below is excerpted from the October 05, 2020 edition of Quigley’s...

Investment Grade Debt Capital Markets Adds $5.90b in New Issuance; Mischler Active Co-Mgr for Entergy and SoCalEd

Below is excerpted from the September 28, 2020, edition of Quigley’s Corner, Mischler Financial Group’s daily debt market coverage and commentary distributed to Fortune 500 treasury teams, leading institutional investors, and the sell-side’s most recognized fixed...

Primary Debt Capital Markets

1000+Offerings | 230+ Issuers | $2 Trillion+

Investment Grade | High Yield Corporate

Municipal Debt | Agency Debt | Structured Products

Primary & Secondary Equity Capital Markets

230+ Initial Public Offerings

175+ Follow-on Offerings (115 Issuers)

Better Execution

10b-18 | 10b5-1 Broker Rotation Schedules

US Equities | ETFs | International Equities

949.720.0640

949.720.0640 800.820.0640

800.820.0640