Debt Market Commentary

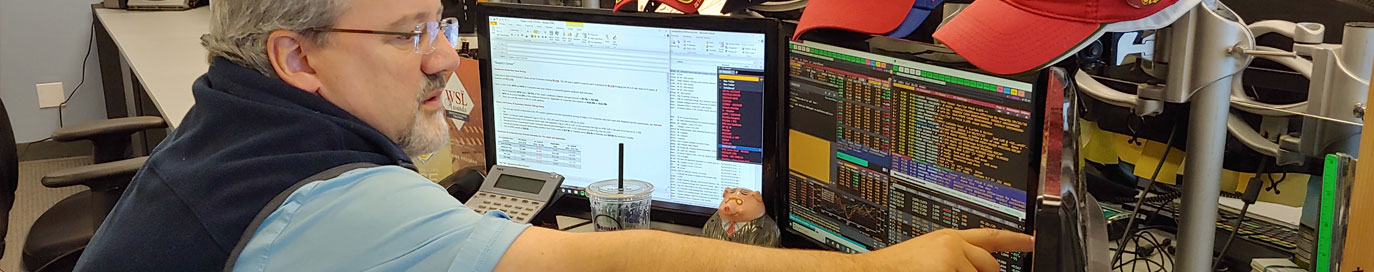

Daily analysis of primary DCM Investment Grade & HY Corporate Debt activity distributed under the banner “Quigley’s Corner” to Fortune corporate treasury teams, asset managers who rely on Mischler, and Wall Street’s top fixed income syndicate desks. Insight includes a deep dive into the metrics of the day’s noteworthy new issuance, pending debt offerings, rates trading markets, and prospective M&A activity.

IG Corporate Re-Cap; Mischler Co-Manager on Duke Florida and Deutsche Bank AG/NY

“Quigley’s Corner” 11.21.19 Investment Grade New Issue Re-Cap - Centene Prices $7b 3-Part; Mischler Named Co-Manager on Duke Florida and Deutsche Bank AG/NY Below is excerpted from today's edition of Quigley's Corner, authored and published by Ron Quigley, Mischler...

Mischler Earns Co-Manager Role on $500mm Morgan Stanley PerpNC5 Series “L” $25 par Preferred

Quigley’s Corner 11.18.19 : IG Corporate Primary & Secondary Market Talking Points - Mischler Earns Co-Manager Role on $500mm Morgan Stanley PerpNC5 Series “L” $25 par Preferred Below is excerpted from today’s edition of Quigley’s Corner, authored and published by...

Mischler Named Co-Manager on Synchrony Financial $750m Preferred Offering

Quigley’s Corner 11.06.19 Mischler Earns Co-Manager Role on Synchrony $25 Preferred Deal Below is excerpted from the IG Corporate Primary and Secondary Market Talking Points section of today’s edition of Quigley’s Corner, authored and published by Ron Quigley,...

Mischler Financial Group Mandates: Comcast; Eli Lilly; Ford Motor Credit; State Street

Quigley’s Corner 10.29.19 Mischler Earns Roles on Four Debt Market Deals Raising $10billion Below is excerpted from the IG Corporate Primary and Secondary Market Talking Points section of today’s edition of Quigley’s Corner, authored and published by Ron Quigley,...

Citibank Floats Debt Offering To Support Veteran-Owned Broker Dealers

Quigley’s Corner 05.15.19 : Citibank NA Veteran-Friendly Debt Offering Investment Grade New Issue Re-Cap – Bank and Fin Dominate; Citibank NA Issues Veteran Deal Honoring Memorial Day Month of May Today’s IG Primary & Secondary Market Talking Points –Mischler...

Bristol-Myers Squibb $19b 9-Part Bond Offering-That’s One VERY Big Deal

Quigley’s Corner 05.08.19: Bristol-Myers Squibb (NYSE:BMY) $19billion 9-Part Bond Offering; a REALLY BIG DEAL! Investment Grade New Issue Re-Cap – All About Bristol-Myers Squibb’s $19b 9-Part; Team Mischler serves as Active Co-Manager Introducing the Largest New Issue...

Utilities Light Up DCM New Issuance; Mischler Memorial Day Month Pledge

Quigley’s Corner 05.06.19: Utilities Light Up DCM New Issuance; Mischler Memorial Day Month Pledge Mischler Memorial Day Month Pledge Announcement Today’s IG Primary & Secondary Market Talking Points Investment Grade New Issue Re-Cap – Trade Talks Stymie...

Investment Grade New Issue Re-Cap: April Hits the Mark w Walk-Off Home Run

Quigley’s Corner 04.30.19: $93.6b in IG Bonds Floated In April; Boeing's $3.5b 5-part Scores Run Batted-In for Month's Record Tally Below is the opening extract from Quigley’s Corner aka “QC” Tuesday, April 30, 2019 edition distributed via email to institutional...

Week’s New Corporate Bond Issuance Starts Strong; Mischler Debt Market Comment 02.11.19

Quigley’s Corner 02.11.19: Week’s New Corporate Bond Issuance Starts Strong Below is the opening extract from Quigley’s Corner aka “QC” Monday, February 10, 2019 edition distributed via email to institutional investment managers, lead underwriter syndicate desks...

Fannie Mae Launches 3rd SOFR Deal; Mischler Mandated for Selling Group Role

Fannie Mae Announces $2.0 Billion Secured Overnight Financing Rate (SOFR) Transaction, Encouraging Market Participation; Third SOFR Offering Grows Investor Base; Diversity-certified broker-dealers Mischler Financial Group and CastleOak Securities designated as selling...

Municipal Bond New Offerings Scheduled Week of Jan 22

Mischler Muni Market Update; New Municipal Bond Offerings Scheduled for Week of January 22 2019- Mischler Muni Market Outlook provides public finance investment managers, institutional investors focused on municipal debt, and municipal bond market participants with a...

ABIBB Beer Bonds Float with $15.5b Bubbles

Quigley’s Corner 01.10.19-ABIBB 6-Part Beer Bonds Go Down Smoothly w Corporate Debt Buyers Investment Grade New Issue Re-Cap – $17.80 Billion Day and One Heck of a Lot of Beer Money - ABIBB’s $15.5b 6-Part “QC” Q&A: Celebrating Beer Bonds with Classics From Norm...

IG Corporate Debt Issuers Show Confidence Despite Tricky Stock Market Action

Quigley’s Corner 01.03.19 – IG Corporate Debt Issuers Start New Year With Show of Confidence In Face of Equity Market Volatility Investment Grade New Issue Re-Cap – Big Day $10.10 Billion Priced As Issuers Navigate “Tricky” Market Today’s IG Primary & Secondary...

Investment Grade Corporate Debt New Issuance : Healthy Grades for UNH $3b 4-Part

Quigley’s Corner 12.13.18-- A Healthy Placement for UNH $3b 4-Part Investment Grade New Issue Re-Cap – Third Time’s a Charm! UNH Pulls Trigger After Standing Down Monday and Tuesday Today’s IG Primary & Secondary Market Talking Points Syndicate IG Corporate-only...

Dominion Energy VEPCO Debt Deal Distilled; Mischler DCM Commentary

Quigley’s Corner 11.26.18 : Dominion Energy VEPCO Debt Deal Distilled "From an ethical standpoint, serving those who sacrificed so much to serve us is the right thing to do." - Thomas F. Farrell, II, Dominion Energy Chairman, President and CEO Investment Grade New...

Primary Debt Capital Markets

1000+Offerings | 230+ Issuers | $2 Trillion+

Investment Grade | High Yield Corporate

Municipal Debt | Agency Debt | Structured Products

Primary & Secondary Equity Capital Markets

230+ Initial Public Offerings

175+ Follow-on Offerings (115 Issuers)

Better Execution

10b-18 | 10b5-1 Broker Rotation Schedules

US Equities | ETFs | International Equities

949.720.0640

949.720.0640 800.820.0640

800.820.0640